Happy Friday! Federal Reserve Chair Jerome Powell once again took center stage at the Kansas City Fed’s annual retreat in Jackson Hole, Wyoming, today echoing a familiar tone of caution against lingering inflationary pressures. Powell’s message was unmistakable – the battle against inflation is far from over, and the Fed is prepared to take stronger measures if necessary.

The central theme of Powell’s remarks revolved around the uncertainty of the economic landscape, with inflation rates still outstripping the comfort zone of policymakers, despite showing some signs of easing. The Chair reiterated that while the Fed has made significant progress, it is not the time for complacency. They are willing and ready to raise rates further to ensure that inflation moves sustainably toward their 2% target.

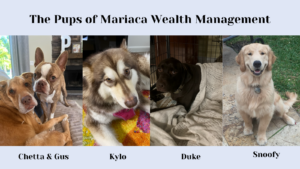

So, while the world of economics will surely remain abuzz with Powell’s remarks, there is a special cause for celebration that many across the nation are gearing up for – National Dog Day. This annual event, celebrated every August 26th, is a reminder of the joy, companionship, and unwavering love our four-legged friends bring into our lives. While Powell’s speech is a sober reminder of the complexities of the global economy, National Dog Day emphasizes the simple joys and unconditional love that often keeps us going through turbulent times. To learn about our firm’s furry friends, please see FIRM UPDATES.

Fed Chair Powell Calls Inflation ‘Too High’ and Warns That ‘We Are Prepared to Raise Rates Further’.

By CNBC

Key Takeaways:

- While acknowledging that progress has been made, the central bank leader said inflation is still above where policymakers feel comfortable.

- The speech resembled remarks Powell made last year at Jackson Hole, during which he warned that “some pain” was likely as the Fed continues its efforts to pull runaway inflation back down to its 2% goal.

- A strong economy and decelerating inflation also give the Fed room to “proceed carefully” at upcoming meetings.

TD Economics: Addressing Issues Impacting the Economic and Financial Outlook

By TD Economics

Questions Addressed:

- What’s the implication of China’s abrupt slowdown to the global outlook and inflation?

- Is the commodity market oversold and are the risks shifting to a rebound?

- Is the recent S. dollar weakness the start of a larger trend?

- With inflation easing in the S., how long will peak interest rates remain?

- Is it true that contracting U.S. gross domestic income predicts a recession, even though GDP is expanding?

- Why is U.S. investment showing unusual resilience in a high rate environment?

- Are higher rates having any effect on S. consumers yet?

- Are we seeing a turn in the S. labor market?

Vertigo: Market Succumbs to Myriad Pressures

By Schwab Market Perspective

Key Takeways:

- Long and variable lags

- Pullback underway

- High-flyers taking a breather

Why Investors Need Perspective Amid a Market Pullback, Fears Over China, and More

By Clearnomics

Key Takeaways:

- In the long run, the stock market has overcome even significant challenges.

- Despite how some investors may feel, the stock market has been calm.

- Global stocks have generated strong this year.

TD AMERITRADE TO SCHWAB TRANSITION:

In November 2019, Charles Schwab proposed a $26 billion acquisition of TD Ameritrade, a deal finalized in 2020. The firms have since been focusing on a smooth integration combining the best features of both companies. The transition will be complete this Labor Day, and the TD Ameritrade name will be retired.

It’s Almost Time to Move to Schwab – Make Sure You’re Ready!

We want to remind you that your account is moving to Schwab on Friday, September 1, starting at 8:30 p.m. ET. The move will take place automatically and securely, so all you need to do is create your new Schwab Login ID and password. If you already have a Schwab account or you’ve already set up your new Schwab login info, there’s nothing else you need to do.

A Few Things You Can Do To Prepare:

- Set up your new Schwab Login ID and password now: Visit the Client Information Hub for step-by-step instructions for setting up access to your account.

- If you’re enrolled in paperless document delivery, you must have your Schwab login info set up to keep receiving your statements and tax documents electronically.

- Get ready to use Schwab.com and the Schwab Mobile app by accessing our learning resources, including how-to videos, online guides, and live webcasts with Q&A.

- Download the Schwab Mobile app so you’ll be able to access your account from the palm of your hand after the move is complete on Tuesday, September 5.

What to Expect:

When the move is complete on Tuesday, September 5, at 5 a.m. ET, your assets, positions, and account information will be waiting for you when you log in to your account on Schwab platforms.

Additional Resources to Stay in the Know:

- Explore the Schwab Transition Center, which includes personalized information about your move, with specifics by account type. Simply log in to your TD Ameritrade account.

- Visit the Client Information Hub for general account transition information, including helpful FAQs, videos, and more.

- Attend the Moving Made Easy webcast to get the answers to your top questions about the transition to Schwab.

Please let us know if you have any questions!

service@mariacawealth.com

(561) 650-8061

SPECIAL MESSAGE FROM SERGIO ABOUT SCHWAB’S ACQUISITION OF TD AMERITRADE:

UPCOMING EVENTS:

Back By Popular Demand

We’re thrilled to have Weston Wellington, Vice President with Dimensional Funds and a distinguished market historian as our special guest speaker at our upcoming October client event. After hosting Weston in 2017 and receiving overwhelmingly positive feedback, it became evident he needed an encore.

Back in 2006, when I was considering Dimensional funds, Weston significantly influenced my choice. For years, he penned an annual article drawing comparisons between analysts’ forecasts and the actual year-end results. The consistent message was evident: the predictions of economists and Wall Street analysts are as reliable as those of astrologers, warranting a healthy dose of skepticism.

Let me be clear: I believe it’s imperative to be well-informed about critical matters like finances and investments. However, hanging onto the short-term forecasts of economists or analysts isn’t the way to do this.

Mariaca Wealth Management Annual Client Shred Event Featuring Special Guest Speaker Weston Wellington, Vice President of Dimensional Funds

When: Wednesday, October 18th

Where: Hilton – West Palm Beach | 150 Australian Ave. West Palm Beach, FL

Time: 6 p.m. to 8 p.m.

About Wes Wellington:

Weston Wellington has accumulated over 40 years of experience in the investment industry. He serves as the Vice President of Dimensional Fund Advisors and is one of the firm’s most engaging speakers, helping to shed light on the firm’s unique evidence-based approach to investing. Weston stresses how an equilibrium-based investment strategy may be a good way to pursue investment success and why investors are unlikely to hear about this approach from the usual sources of financial advice. Weston also is an accomplished writer whose column, Down to the Wire, appears regularly on Dimensional’s client website.

Prior to joining Dimensional in 1995, Weston was director of research at LPL Financial Services, Inc. He holds an MBA from the University of California, Los Angeles, and a bachelor’s degree from Yale University.

Watch Wes Wellington speak on Dimensional’s Philosophy

The Forum Club of Palm Beaches Presents U.S. Senator Marco Rubio:

When: Wednesday, October 18th

Where: The Kravis Center: Cohen Pavilion

Time: 12 p.m. to 1 p.m. (Doors open at 11 a.m.)

For over 40 years, The Forum Club of the Palm Beaches, a non-partisan political and public affairs organization, has hosted speakers from former Presidents, U.S. Supreme Court Justices, and thought leaders whose words and actions affect the world in which we live.

As a supporting member, Mariaca Wealth Management sponsors a table at these events for our local clients and friends.

Limited spots are available, and seats fill up quickly!

SMART MONEY MATTERS:

The year is zipping by! But, hey, realizing we’re halfway through isn’t all bad. It’s an excellent opportunity to evaluate our progress and refocus our efforts for the remainder of the year. So, how are you doing with your 2023 financial goals? Here is a mid-year financial checklist to help ensure you are on track.

Retired Checklist:

- You are sticking to your budget.

- All of your financial accounts have beneficiaries.

- Your estate plan is current, and your beneficiary designations, personal representative & trustee appointments are accurate.

- Don’t forget your living will and healthcare surrogate.

- You have automated bill paying and savings set up.

- You are keeping track of your ‘bucket list’ goals and making plans!

Currently Employed Checklist:

- You are sticking to your budget.

- You have an emergency fund (3-6 months)

- Retirement contributions are on track.

- College savings is on track.

- HSA contribution goals are on track.

- You have set-up automated bill paying and savings.

- Your beneficiaries are up to date.

- All financial accounts have beneficiaries.

- You and your family are protected with adequate disability & life insurance.

- You are making progress in reducing your debt as planned.

If you’ve been crushing your goals like a champ, kudos! Keep doing what you’re doing. But if you’ve slid off the path a bit and haven’t been sticking to your plan, remember, there’s no time like now to get back on track. Don’t wait another day to get started. Trust me, there’s nothing like that feeling of knowing you’re making real progress on your goals.

If you need any help, please let us know.

QUARTERLY RESOURCES:

Halftime Report Webinar with Economist Fritz Meyer

This webinar will cover the latest data on:

- Federal Reserve actions and outlook

- The jobs situation

- ISM Purchasing Managers Index

- Inflation measures

- U.S. debt situation

- Household balance sheets

- Consumer income and spending

- Retail sales

- Housing starts

- Consensus forecast For The Quarterly WSJ Survey

- Latest GDP Now forecast for Q2 2023 GDP

- M2 and the liquidity picture

- And, much more…

Recently, our good friend, economist Fritz Meyer joined us for another insightful annual Halftime Report Webinar on July 12. During the webinar, Fritz put the current financial and economic numbers into perspective, comparing them with past records, and discussed how certain economic metrics, like the LEI, can become outdated because the economy is constantly changing. Fritz didn’t stop there, though. He also reviewed some reliable, time-tested indicators like the Federal Reserve’s stock valuation, price-earnings ratios, and other key metrics to help us understand where we are right now and how things might shape up in the near and distant future.

FIRM UPDATES:

Happy National Dog Day to all our canine companions out there! We set aside tomorrow to give some extra love and appreciation to our furry best friends. In light of this special occasion, we at Mariaca Wealth want to turn the spotlight onto the true stars – our cherished dogs.

Let’s raise a paw in celebration for Chetta’s charm, Gus’s playful antics, Kylo’s majestic demeanor, Duke’s regal presence, and the sheer endearment of Snoofy.

The profound bond we share with our pups is beyond mere words – it’s a deep connection that resonates in the very core of our hearts. This sentiment is beautifully captured in Jimmy Stewart’s evocative poem about his dog, Beau. The poem, dripping with emotion and nostalgia, is a testament to the deep love and camaraderie shared between a man and his dog.

In many ways, it reminds us of those deeply touching videos that circulate on the internet, capturing the indescribable moments when soldiers return home to their eagerly waiting pets. Just as Stewart reminisces about Beau’s quirks and shared moments, those videos encapsulate the raw, unfiltered joy of reunions, as dogs leap, bark, and often cry in sheer happiness. Both the poem and these reunion videos serve as heartwarming reminders of the love and loyalty that our canine companions bring into our lives, demonstrating that even in our absence, the bond remains unbroken.

Please enjoy Jimmy’s poem and a compilation video of soldiers coming home to their dogs below:

Jimmy Stewart Reads A Touching Poem About His Dog Beau Soldiers Come Home To Dogs Compilation

Our Weekly Wave is all about giving you good insights and valuable information. While we’re good at managing wealth and financial planning, please remember; this content is for informational purposes only and is not legal, tax, investment, financial, or other professional advice. So while we hope to provide insightful and helpful knowledge, please don’t take it as official guidance.

![Image001[45][97]](https://www.mariacawealth.com/wp-content/uploads/2023/08/image0014597-300x52.png)