Welcome to week 15. As I write this, it’s Thursday, and I’m flying up to Albany, NY, to bid farewell to my cousin. It’s never easy to say goodbye and see loved ones in pain, but it’s another reminder: our days are precious, and we should do our best to make them count.

October is Cybersecurity Awareness month, and below you will find our updated Top Ten Things to Do Now to Prevent Identity Theft. This week, I received two notices that my personal information may have been compromised in two separate data breaches. Such incidents are becoming all too familiar and underscore the importance of staying informed, alert, and proactive in safeguarding our data in today’s vulnerable digital landscape. Please take the time to review our report and ensure you are taking appropriate safety precautions. If you have any questions, please let us know.

It’s been a busy week for financial markets as we digest the FOMC September policy minutes and take in the wholesale and consumer inflation reports, known as the Producer Price Index (PPI) and Consumer Price Index (CPI). These indicators confirm that this inflation fight’s ‘final mile’ will be the most challenging. Nevertheless, we are reassured by continuing progress in this battle and our resilient economy.

To help make sense of the latest news and follow up on the trends we discussed during our Halftime Report webinar in July, I’ll be recording a Q3 Economic Report Webinar with economist Fritz Meyer this coming Tuesday. We’ll delve into the latest economic and market developments and provide historical context to the current scenario. Then, on Wednesday, we are hosting Weston Wellington, Vice President of Dimensional Funds, at a client event where he will present ‘Stay in Your Seat,’ which explores a 50-year history of markets and the media. We will be sharing replays of both here soon.

Finally, the news and reports from the Middle East are deeply distressing and heartbreaking and could have broader security and economic implications. This situation remains one of the most pressing issues our world confronts and we support Israel’s right to security and simultaneously recognize the aspirations of the Palestinian people. As this unfolds, we hope for peace and constructive dialogue to guide all sides toward resolution and healing.

With gratitude,

Sergio

Key Economic News:

- Consumer prices rose 0.4% in September, more than expected.

- Wholesale inflation rose 0.5% in September, more than expected.

- IMF hikes U.S. growth forecast for 2023, leaves global outlook unchanged.

Conflict in the Middle East

By Schwab Market Perspective

Key Takeways:

- While the human toll is unimaginable, the market’s assessment is that the latest outbreak of war in the Middle East is unlikely to be a material risk to long-term investors.

- In theory, the market could either view the conflict as a risk-off development, pushing bond yields lower or the impact on oil means the conflict isinflationary, driving bond yields higher.

- The U.S. could potentially bolster sanctions against Iran, after tacitly allowing Iran to ship more oil in violation of sanctions given tight global supplies. If the U.S. cracks down on those shipments, it could further tighten supplies.

How Middle East Conflicts Have Historically Impacted Markets

By Clearnomics

Key Takeways:

- The impact of regional wars on markets depends on the economy.

- Over long periods of time, markets have recovered from geopolitical conflicts.

- Oil prices have risen following the attack on Israel.

Cybersecurity Awareness Month!

As our private lives and sensitive information become increasingly exposed in the digital world, understanding the associated risks and implementing robust safeguards to protect our identity and secure our content has never been more critical.

Our report, Top Ten Things to Do Now to Prevent Identity Theft, offers key best practices for protecting your digital identity and valuable data. Adopting and consistently applying these and other protective measures is essential to avoid the time-consuming and significant turmoil – financial, emotional, and otherwise – that comes with experiencing identity theft.

QUARTERLY RESOURCES:

COMING SOON: The Mariaca Wealth Q3 Quarterly Economic Report with economist Fritz Meyer

Recording Date: October 17th, with a release soon after.

Fritz will contextualize current financial and economic metrics versus long-term historical data and review and compare the shifts since our July Halftime Report webinar.

Key Discussion Points:

- Where Are We Headed? Will we experience a soft landing, hard landing or no landing at all?

- Policy Insights: As the post-COVID economic landscape approaches a crucial junction, FOMC policy decisions stand paramount, particularly with a possible recession looming.

- Data Review: Fritz will dissect the latest fundamental data driving the economy and financial markets.

- Projections & Policy: A deep dive into FOMC projections for the federal funds rate and decoding the language changes in recent monetary policy releases.

Stay tuned!

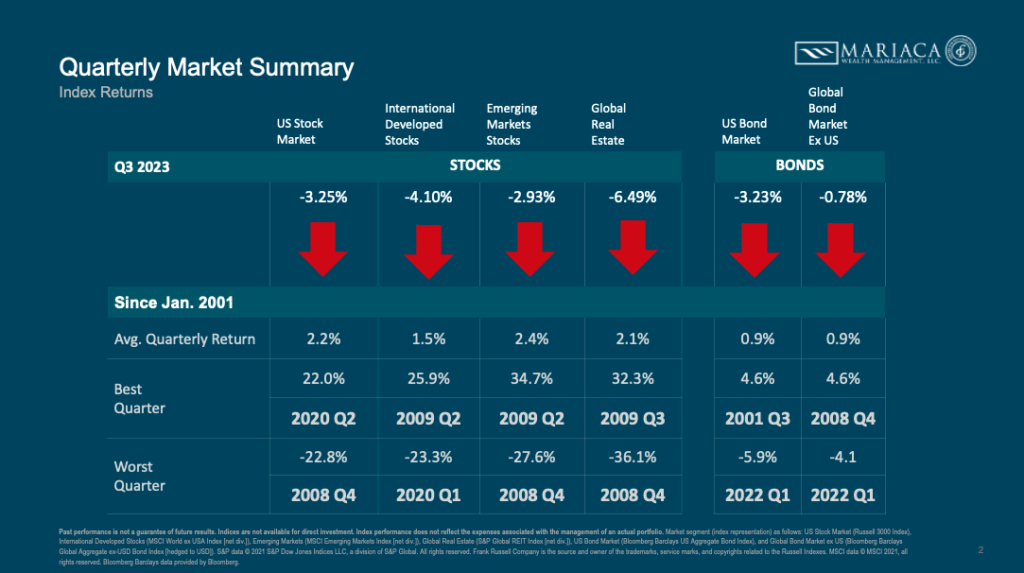

Q3 2023 Market Summary:

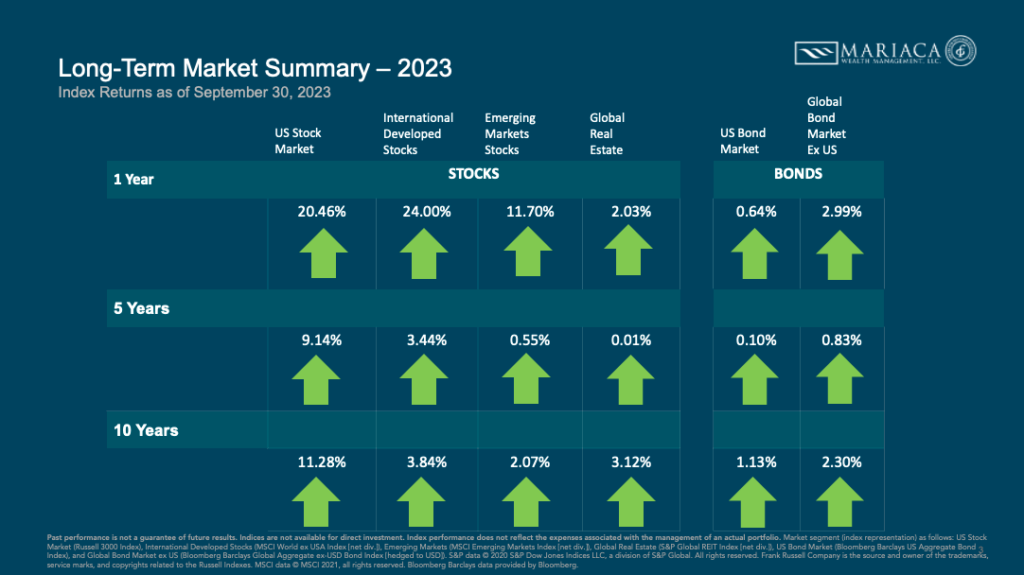

Q3 2023 Long-Term Market Summary:

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect theexpenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the RussellIndexes. MSCI data © MSCI 2021, all rights reserved. Bloomberg Barclays data provided by Bloomberg.

Markets in Review: Q3 2023

Value’s Comeback Despite Global Equities’ Drawdown in Q3:

Key Takeaways:

- Global stocks dropped after last quarter’s positive performance.

- 5-year forward inflation expectations in the United States remained below 3% for the quarter.

- The 10-Year Treasury yield rose by nearly 80 basis points to 4.6% this quarter, marking its highest level in approximately 16 years.

- Information technology, REITs, and utlities lagged the overall market. Large growth stocks were the biggest detractors, as names like Apple returned -11.6% while Microsoft returned -7.1%.

- Value stocks generally outperformed growth stocks across US, non-US developed, and emerging markets.

- In the US, the value premium was positive despite generally negative size and profitability premiums.

What I’m Reading:

James Clear’s ‘Atomic Habits’ (which I’ve enjoyed in audio format twice) offers a compelling exploration into our behaviors, dissecting why we act as we do and how our actions can serve or impede us both immediately and over the long term. Clear underscores a pivotal concept: we are the sum of small, consistent actions leveraged over time. While they may seem inconsequential in isolation, they are powerfully transformative over time. In contrast, actions yielding immediate rewards often limit the long-term progress we hope to achieve. If you have big, ambitious goals but feel stuck – give this one a try (actually, finish it). This book has many great stories and examples – it is highly actionable and one you can revisit repeatedly and probably should!!

Schwab Alliance: Simple, Fast, Secure

To learn more about all of the great features of the Schwab Alliance custom website and mobile platform, please watch this information video:

Click here to watch the video.

To Create Your New Schwab Login ID and Password:

- Have your Schwab or TD Ameritrade account number handy and click: www.schwaballiance.com.

- Select “New User?” – blue link under Log In (middle of screen) and follow the prompts.

CLIENT EVENTS:

Please Join Us For A Special Client Dinner and Shred Event

We’re excited to welcome Weston Wellington, Vice President of Dimensional Funds, and distinguished market historian, as our keynote speaker for the upcoming October client dinner event. After hosting Weston in 2017 and receiving overwhelmingly positive feedback, it became evident he needed an encore.

In 2006, while I was evaluating Dimensional Funds, Weston’s insights greatly informed my decision. For years, he penned an annual article juxtaposing Wall Street analysts’ forecasts with actual year-end outcomes. The recurring theme is unmistakable: the predictions of economists and Wall Street analysts are as reliable as those of astrologers, warranting a healthy dose of skepticism.

Stay In Your Seat!

Weston Wellington’s “Stay in Your Seat” presentation is an entertaining and insightful journey through over five decades of investment news headlines, media narratives, and the real-world outcomes for investors who followed the implied advice. You will walk away with a better understanding of today’s media landscape, recognizing how little things have truly changed besides the surge of media outlets.

Additionally, you’ll better understand how and why your money is invested the way it is.

Event Details:

When: Wednesday, October 18th

Where: Hilton – West Palm Beach | 150 Australian Ave. West Palm Beach, FL

Time: 6 p.m. to 8 p.m.

Spots are filling up quickly and we are nearing capacity.

If you wish to attend, please let one of our team members know ASAP!

About Wes Wellington:

Weston Wellington, Vice President of Dimensional Fund Advisors, has over four decades of investment industry expertise and is recognized as one of the firm’s most captivating speakers. Weston’s presentations illuminate Dimensional’s distinctive evidence-driven investment approach and the merits of an equilibrium based investment strategy as an effective avenue towards investment success.

Additionally, Weston critically assesses contemporary financial and investment media, underscoring why investors are unlikely to hear about this approach from the usual sources of financial advice.

In addition to the presentation, we will have an on-site shred truck to allow you to dispose of your personal documents securely and safely!

The Forum Club of the Palm Beaches

For over four decades, The Forum Club of the Palm Beaches, a non-partisan political and public affairs organization, has welcomed a parade of illustrious speakers, including former Presidents, U.S. Supreme Court Justices, and influential thought leaders whose words and deeds shape our world.

As a proud supporter, Mariaca Wealth Management is delighted to sponsor a table for our local clients and friends at these events. Kindly note that seating is limited and available on a first-come, first-served basis. If you’d like to attend a particular luncheon, please reach out to Victoria, at victoria@mariacawealth.com.

Upcoming Forum Club Events:

Secretary of Transportation, “Mayor Pete”, Pete Buttigieg

Tuesday, October 17, 2023 at 1 p.m.

REQUEST TO JOIN OUR WAITLIST.

Former Congressman and CNN Political Commentator, Adam Kinzinger

Tuesday, October 24, 2023 at 12 p.m.

REGISTRATION IS CLOSED FOR THIS EVENT.

FIRM UPDATES:

Annual Hats Off Awards!

On Tuesday, October 3rd, team members Dana, Victoria, Rachel, and Sergio attended the 7th Annual Hats Off Awards for Nonprofit Excellence, held at the Kravis Center.

Nonprofits First of Palm Beach County produces this event each year to recognize and honor our nonprofit community’s remarkable and impactful contributions.

Mariaca Wealth Management was once again proud to be an event sponsor, and Sergio, who serves on the board of Nonprofits First, had the distinct honor of announcing the recipient of the Nonprofit of the Year award in the Large Nonprofit category.

Our Weekly Wave is all about giving you good insights and valuable information. While we’re good at managing wealth and financial planning, please remember; this content is for informational purposes only and is not legal, tax, investment, financial, or other professional advice. So while we hope to provide insightful and helpful knowledge, please don’t take it as official guidance.