Anthropologists tell us that we are evolutionarily hardwired to be on the lookout for danger, inclined to focus on negativity and with a seemingly magnetic attraction to bad news. Over time, this has served our species well by keeping us safe, increasing survival rates, and helping us pass on our genes.

Unfortunately, despite our universal desire to stay well-informed, our ancient predisposition makes us ideal targets for today’s expansive media, which prioritizes capturing our attention with content designed to distract and unsettle us rather than provide genuine information.

The media’s focus on negativity is a phenomenon that has been around for a while. In 1890, renowned news publisher William Randolph Hearst coined the phrase, ‘If it bleeds, it leads,’ upon recognizing that gruesome crime stories captivated the public’s eye more effectively than positive ones. The media has been honing this strategy ever since.

So why do I bring this up? For two reasons. First, we should actively question our information sources and assess the potential damage they may be inflicting on our well-being. Next, and this is my main point, as investors, we are not well-served by a media cycle fixated on the crisis of the day if we aim to adhere to the fundamental principles of investing success, which I believe include:

- Invest in a portfolio to fit your needs and risk tolerance

- Diversify broadly and let markets work for you

- Reduce expenses and turnover

- Manage your emotions & stay disciplined

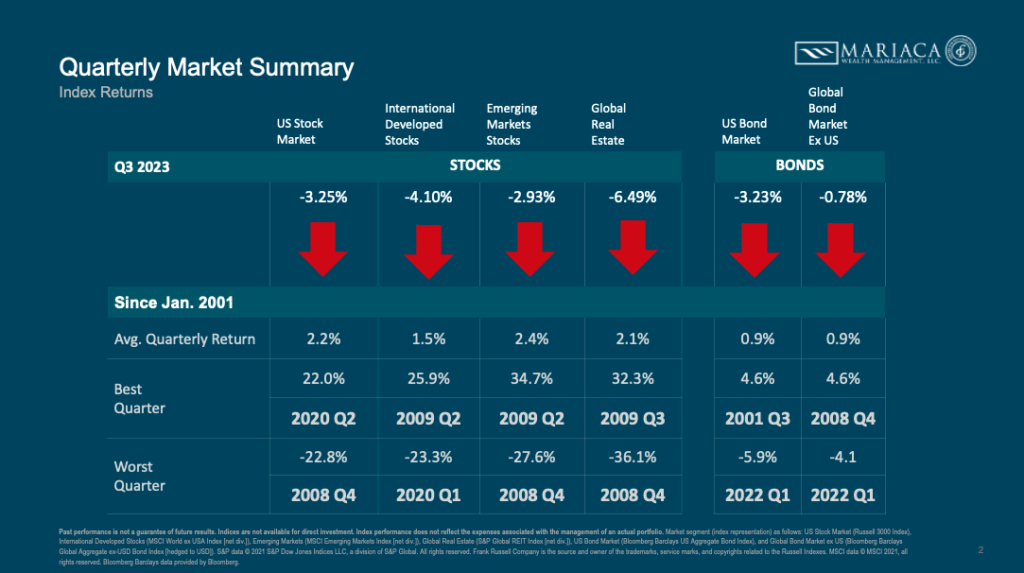

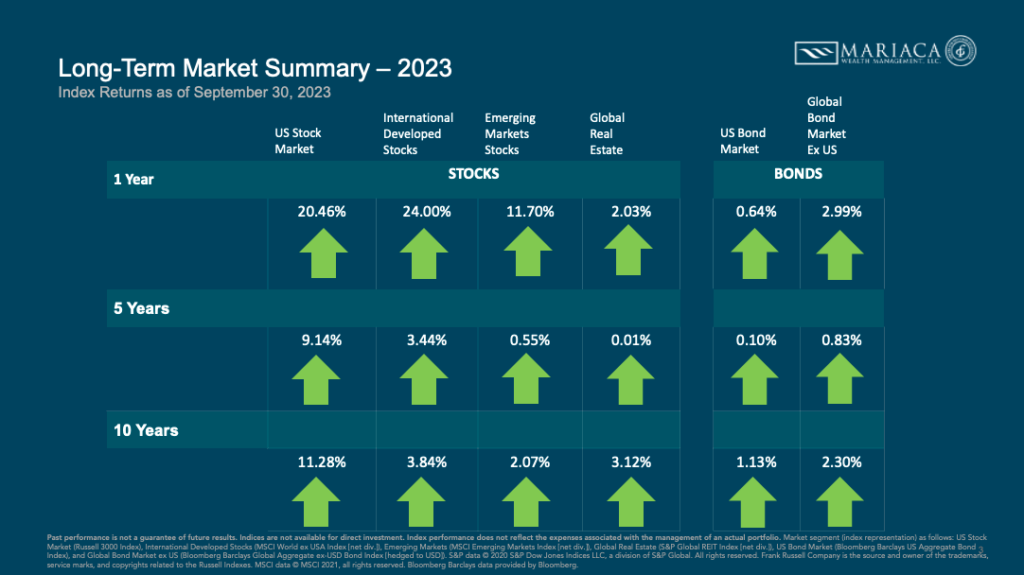

As an interesting exercise, ask yourself if you feel like U.S. markets have performed well over the recent past. Then, review the 3rd quarter market performance in the “Quarterly Resources” section below. Contrast the quarter’s performance with the last year, five-year, and ten-year periods (annual averages). Were you surprised? If you were, it is probably related to a phenomenon known as recency bias and the deluge of negative news stories.

As I often emphasize, the ‘speculation zone’ is five years or less, and the ‘investment zone’ is five years or more. This is because the impacts of short-term volatility, as we saw in the past quarter and even in 2022, tend to be smoothed out over the years, and the probability of positive performance increases with time.

Next, recall the chaos we’ve experienced over the last five and ten years, financial and otherwise. Despite the numerous challenges, U.S. markets have behaved as we might expect, based on previous five and ten-year periods.

So, while I can’t guarantee that the next five and ten years will mirror the past, historical evidence strongly suggests it should. In the meantime, let’s focus on these principles and do our best to tune out the noise and distraction, especially if it stresses us.

For my part, I am consciously limiting my news consumption and reallocating this time towards reading books on my ‘to read’ list. This past week, I read three and revisited a particularly impactful one – ‘Atomic Habits’ that has helped me in this effort. I provide a brief review below.

If you have any great books to recommend, please let me know.

With gratitude,

Sergio

Key Economic News:

- Payrolls soared by 336,000 in September, defying expectations for a hiring slowdown.

- Jobless claims inch up to 207,000, but no sign of rising U.S. layoffs.

- U.S. Service Sector slows modestly in September – ISM Survey.

- Private payrolls rose 89,000 in September, far below expectations, ADP says.

- Surge in job openings in August, Defying Expectations

Paranoid? An Update on Consumer Sentiment

By Schwab Market Perspective

Key Takeways:

- Labor confidence has deteriorated.

- The unemployment rate will eventually start moving up, but the path could be choppy.

- We continue to think the debate between recession and soft landing is too simplistic and doesn’t capture the distinct nuances of this extraordinarily unique cycle.

5 Insights for Long-Term Investors in Q4

By Clearnomics

Key Takeways:

- Stocks have held onto strong gains while bonds have struggled.

- Interest rates have risen to 16-year highs.

- The Fed expects to keep rates higher for longer.

QUARTERLY RESOURCES:

Q3 2023 Market Summary:

Q3 2023 Long-Term Market Summary:

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect theexpenses associated with the management of an actual portfolio. Market segment (index representation) as follows: US Stock Market (Russell 3000Index), International Developed Stocks (MSCI World ex USA Index [net div.]), Emerging Markets (MSCI Emerging Markets Index [net div.]), Global Real Estate (S&P Global REIT Index [net div.]), US Bond Market (Bloomberg Barclays US Aggregate Bond Index), and Global Bond Market ex US (Bloomberg Barclays Global Aggregate ex-USD Bond Index [hedged to USD]). S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the RussellIndexes. MSCI data © MSCI 2021, all rights reserved. Bloomberg Barclays data provided by Bloomberg.

Markets in Review: Q3 2023

Value’s Comeback Despite Global Equities’ Drawdown in Q3:

Key Takeaways:

- Global stocks dropped after last quarter’s positive performance.

- 5-year forward inflation expectations in the United States remained below 3% for the quarter.

- The 10-Year Treasury yield rose by nearly 80 basis points to 4.6% this quarter, marking its highest level in approximately 16 years.

- Information technology, REITs, and utlities lagged the overall market. Large growth stocks were the biggest detractors, as names like Apple returned -11.6% while Microsoft returned -7.1%.

- Value stocks generally outperformed growth stocks across US, non-US developed, and emerging markets.

- In the US, the value premium was positive despite generally negative size and profitability premiums.

What I’m Reading:

James Clear’s ‘Atomic Habits’ (which I’ve enjoyed in audio format twice) offers a compelling exploration into our behaviors, dissecting why we act as we do and how our actions can serve or impede us both immediately and over the long term. Clear underscores a pivotal concept: we are the sum of small, consistent actions leveraged over time. While they may seem inconsequential in isolation, they are powerfully transformative over time. In contrast, actions yielding immediate rewards often limit the long-term progress we hope to achieve. If you have big, ambitious goals but feel stuck – give this one a try (actually, finish it). This book has many great stories and examples – it is highly actionable and one you can revisit repeatedly and probably should!!

Schwab Alliance: Simple, Fast, Secure

To learn more about all of the great features of the Schwab Alliance custom website and mobile platform, please watch this information video:

Click here to watch the video.

To Create Your New Schwab Login ID and Password:

- Have your Schwab or TD Ameritrade account number handy and click: www.schwaballiance.com.

- Select “New User?” – blue link under Log In (middle of screen) and follow the prompts.

CLIENT EVENTS:

Please Join Us For A Special Client Dinner and Shred Event

We’re excited to welcome Weston Wellington, Vice President of Dimensional Funds, and distinguished market historian, as our keynote speaker for the upcoming October client dinner event. After hosting Weston in 2017 and receiving overwhelmingly positive feedback, it became evident he needed an encore.

In 2006, while I was evaluating Dimensional Funds, Weston’s insights greatly informed my decision. For years, he penned an annual article juxtaposing Wall Street analysts’ forecasts with actual year-end outcomes. The recurring theme is unmistakable: the predictions of economists and Wall Street analysts are as reliable as those of astrologers, warranting a healthy dose of skepticism.

Stay In Your Seat!

Weston Wellington’s “Stay in Your Seat” presentation is an entertaining and insightful journey through over five decades of investment news headlines, media narratives, and the real-world outcomes for investors who followed the implied advice. You will walk away with a better understanding of today’s media landscape, recognizing how little things have truly changed besides the surge of media outlets.

Additionally, you’ll better understand how and why your money is invested the way it is.

Event Details:

When: Wednesday, October 18th

Where: Hilton – West Palm Beach | 150 Australian Ave. West Palm Beach, FL

Time: 6 p.m. to 8 p.m.

Spots are filling up quickly and we are nearing capacity.

If you wish to attend, please let one of our team members know ASAP!

About Wes Wellington:

Weston Wellington, Vice President of Dimensional Fund Advisors, has over four decades of investment industry expertise and is recognized as one of the firm’s most captivating speakers. Weston’s presentations illuminate Dimensional’s distinctive evidence-driven investment approach and the merits of an equilibrium based investment strategy as an effective avenue towards investment success.

Additionally, Weston critically assesses contemporary financial and investment media, underscoring why investors are unlikely to hear about this approach from the usual sources of financial advice.

In addition to the presentation, we will have an on-site shred truck to allow you to dispose of your personal documents securely and safely!

The Forum Club of the Palm Beaches

For over four decades, The Forum Club of the Palm Beaches, a non-partisan political and public affairs organization, has welcomed a parade of illustrious speakers, including former Presidents, U.S. Supreme Court Justices, and influential thought leaders whose words and deeds shape our world.

As a proud supporter, Mariaca Wealth Management is delighted to sponsor a table for our local clients and friends at these events. Kindly note that seating is limited and available on a first-come, first-served basis. If you’d like to attend a particular luncheon, please reach out to Victoria, at victoria@mariacawealth.com.

Upcoming Forum Club Events:

Secretary of Transportation, “Mayor Pete”, Pete Buttigieg

Tuesday, October 17, 2023 at 1 p.m.

REQUEST TO JOIN OUR WAITLIST.

Former Congressman and CNN Political Commentator, Adam Kinzinger

Tuesday, October 24, 2023 at 12 p.m.

REGISTRATION IS CLOSED FOR THIS EVENT.

Our Weekly Wave is all about giving you good insights and valuable information. While we’re good at managing wealth and financial planning, please remember; this content is for informational purposes only and is not legal, tax, investment, financial, or other professional advice. So while we hope to provide insightful and helpful knowledge, please don’t take it as official guidance.