You've worked hard to accumulate your nest egg, but do you have a plan for how to turn your savings into income? So many decisions need to be made, decisions about how and when to claim your Social Security benefits, how to plan for income, and how to minimize taxes. It can feel overwhelming. And there's no shortage of “experts” weighing and giving you advice.

At Mariaca Wealth, we believe retirement should be a time to enjoy doing what you love… not years spent worrying whether your savings will last.

We hear daily from clients approaching retirement that the rules around Social Security, required minimum distributions, and varying tax strategies are overwhelming! They want a quick rule of thumb to use … but what they really need is sophisticated software and an implementation strategy that can factor in their hundreds and variables and guide them in creating a truly personalized plan.

With this in mind, we created this case study to help clients see just how much they stand to lose by using a rule of thumb instead of formulating a personalized plan.

Meet Tony and Sarah:

Meet Tony and Sarah, 67 and 65 respectively. Tony retired in 2021 after selling his company. Sarah also retired last year as a nonprofit executive. They have three children (Josh age 40, Alexandra age 36, and Marco age 29), who are all independent and raising families of their own. Tony and Sarah just moved to Florida and, while they feel like they are in good financial shape, the recent pandemic and ensuing market volatility convinced them to revisit their financial plan and reconsider some important decisions.

THE FACTS

Pre-retirement Total Assets: $2,720,000

$1,320,000 in Tony's 401k

$540,000 in Sarah’s 403b

$860,000 in taxable savings in their brokerage accounts and bank accounts

Own a new $750,000 home in Florida, no mortgage

Tony and Sarah each have $500,000 Term Life Insurance Policies to age 80

No pensions

Invested in a moderate risk portfolio of 50% global equity and 50% high-quality fixed income

THE QUESTIONS

- How much do we need to retire?

- How long will our money last?

- Can we afford our current lifestyle?

- How do taxes affect our financial planning?

- How should we create income from our savings?

- How can we make our savings last longer?

- When and how should we each claim Social Security benefits?

- In what order should we tap into our 401k and 403b for income?

- Do our portfolio allocations support our retirement distributions while remaining protected from unnecessary market risk?

- Do we have enough life insurance so the survivor can maintain the same standard of living?

- Should we consider Roth conversions?

- How will increased Medicare premiums impact our retirement?

- How do we adjust our strategy if market conditions change?

The Current Plan:

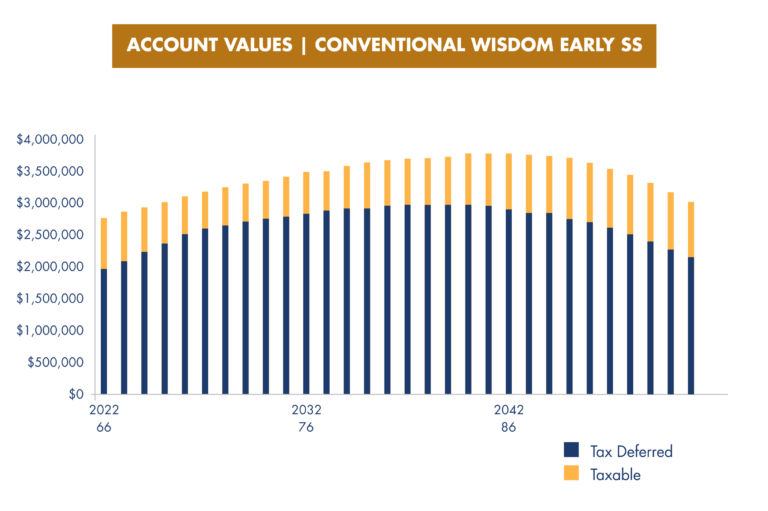

Follow conventional wisdom & make early Social Security withdrawals

Prior to the pandemic, Tony and Sarah anticipated spending $100,000 annually in current -year dollars, adjusted annually for inflation at 3%.

They had the following plan:

- Leave retirement savings in their rollover IRAs.

- Do no Roth conversions.

- Tony planned to begin Social Security benefits based on his earnings record in the estimated amount of $2,279 in February 2022 at age 67.

- Sarah planned to begin Social Security benefits based on her earnings record in the estimated amount of $2,444 in February 2022 at age 65 and 2 months.

- Take additional withdrawals using the conventional wisdom sequence (taxable accounts followed by tax-deferred accounts) to fund the balance of their annual spending needs and tax obligations from joint investment accounts.

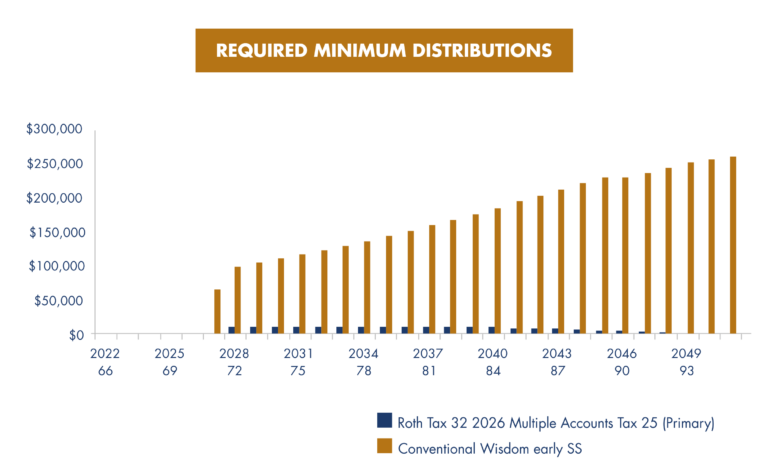

- They planned to begin taking their required minimum distributions at the age of 72 and make up any annual spending shortfalls and taxes from joint investment accounts.

Financial Plan & Income

Distribution Analysis & Comparison

Mariaca Wealth Management reviewed and evaluated their current plan and developed a new plan using sophisticated planning software. The software runs ~100 simulations comparing alternative social security claiming strategies with portfolio distribution strategies (that may include Roth conversions) to extend portfolio life, lower their lifetime taxes, and increase the ultimate estate value for their beneficiaries. After running hundreds of simulations and integrating dozens of data points, Mariaca was able to provide Tony and Sarah with a thoroughly personalized recommendation.

3 Pillars of Retirement Planning

Income Needs & Expense Management

Your expenses won't be consistent from year to year. Some years you'll need more, in others you'll need less. We guide you in determining your likely expenses at every stage of retirement so you are confident the money will be there when you need it.

Spend-down Strategy

Knowing which account to spend from and when is critical in maximizing the longevity of your assets and minimizing taxes. An Income Solver™ Plan analyzes different strategies to be tax-efficient, which may help your resources last longer.

Optimal Social Security Claiming

You might already know that Social Security is complicated. An Income Solver™ Plan gives you step-by-step instructions on when/how to claim Social Security benefits, coordinated with all of your other assets to make your resources stretch longer.

Tony and Sarah's personalized plan integrated the 3 pillars of retirement planning:

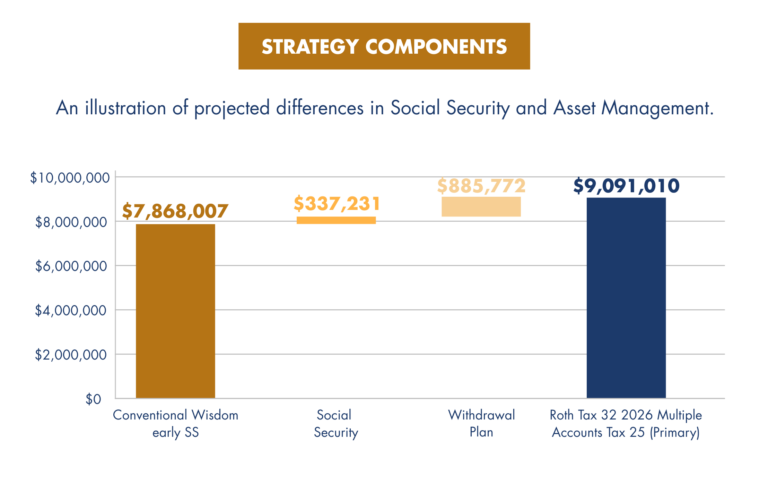

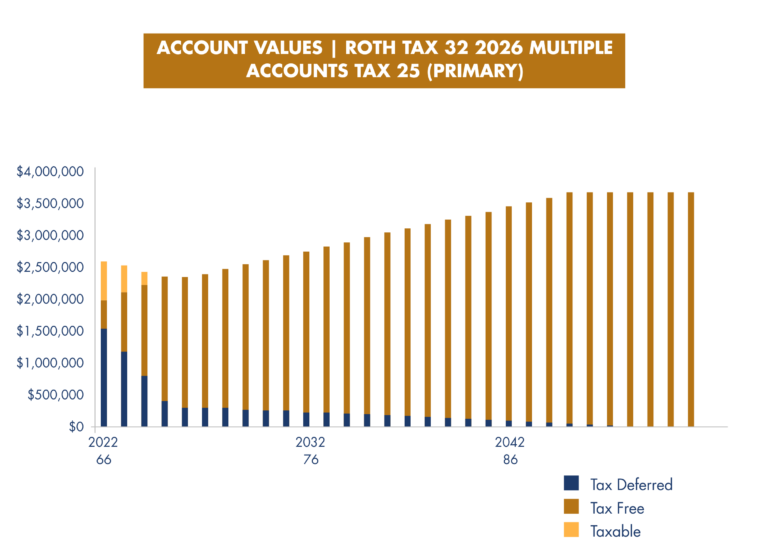

1) income planning, 2) Social Security optimization and 3) tax minimization and is called “Roth Tax 32% 2026 Multiple Accounts Tax 25.”

This means that Tony and Sarah will use Roth conversions to target their tax bracket up to 32%. Then, in year 2026, they will withdraw from multiple accounts (Tax Deferred and Taxable) to target their tax bracket up to 25%, taking advantage of the tax treatment of each type of account. In addition, Tony and Sarah will have an optimized Social Security strategy.

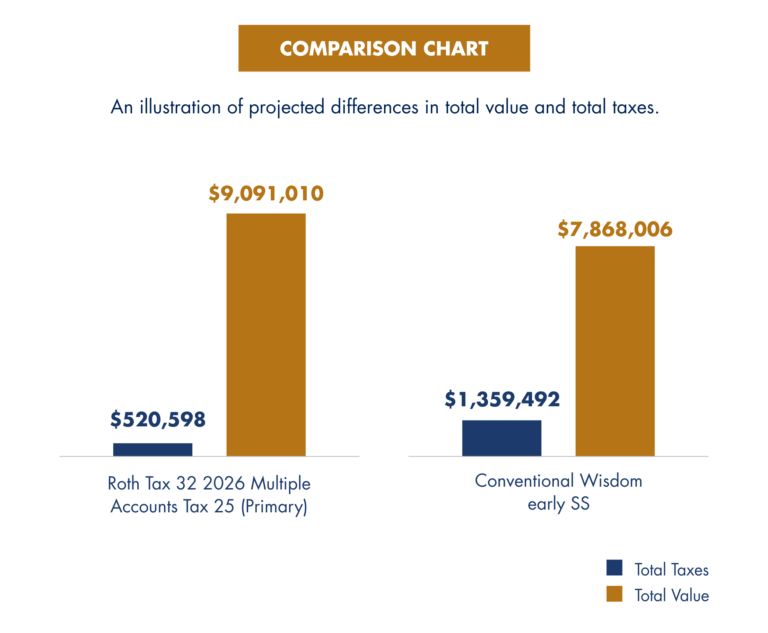

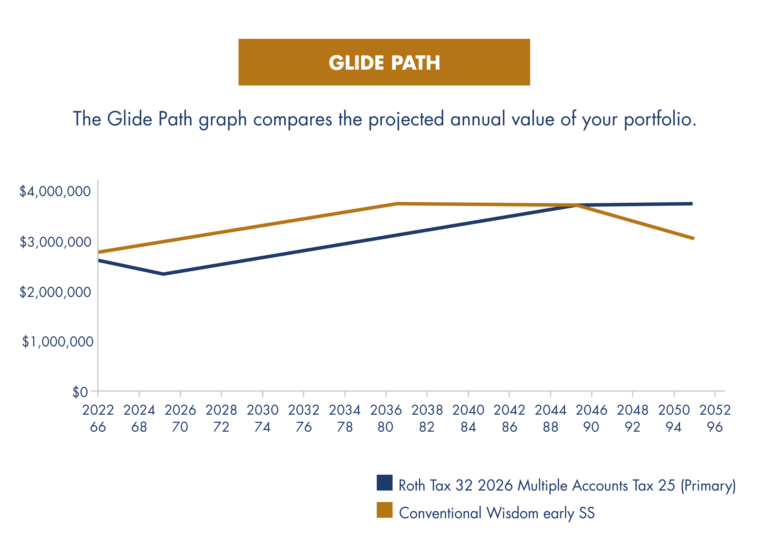

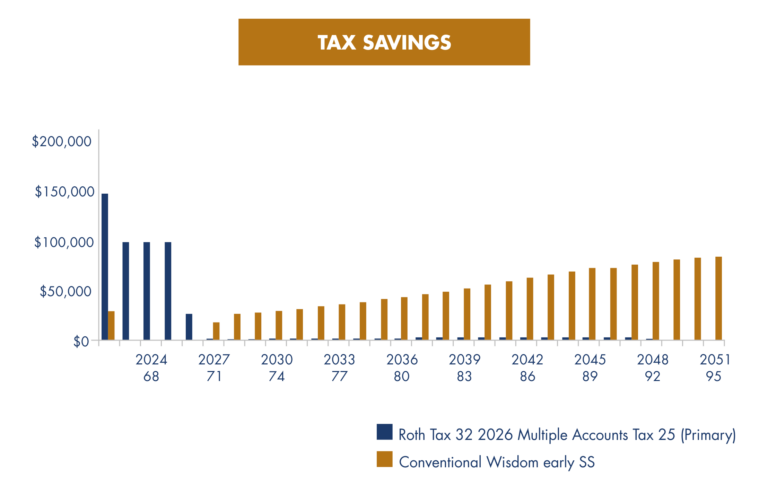

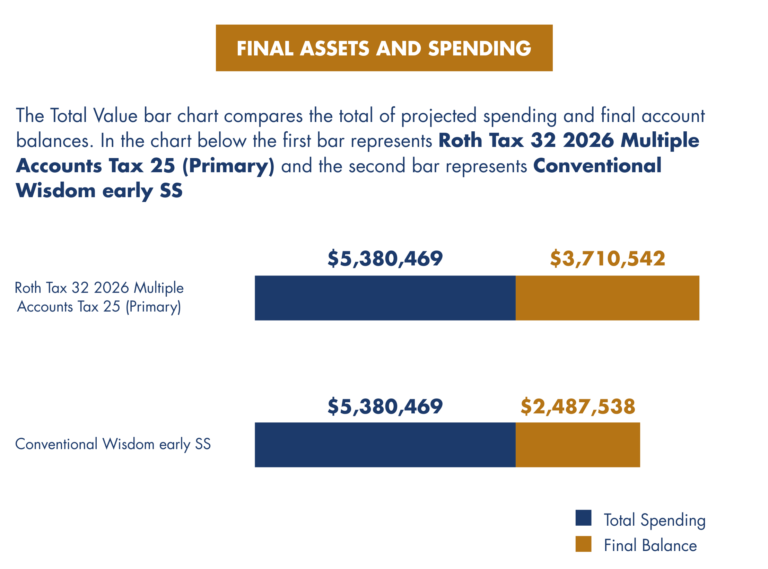

This strategy meets their spending goals while increasing their estate value by 44% or

$1,143,761 and reducing their lifetime projected taxes by $909,931. And remember, the only changes were delaying their Social Security income and optimizing the sequence and order in which Tony and Sarah draw down on their savings.

Let’s take a look at these two plans side-by-side.

This table compares two selected withdrawal strategies to determine the total taxes, total value, and portfolio longevity in months each strategy might yield. It's important that you thoroughly review your entire analysis and supporting educational information to determine if a Roth Conversion is right for you.

WHAT YOU GET WITH YOUR PLAN

- Step-by-step instructions to optimize your Social Security benefits.

- Advice on how to allocate and locate your assets to reduce taxes and other costs. Comparisons showing estimates of how long your portfolio will last based on factors you can control.

- Outline of how to strategically withdraw money from your accounts. Simple schedules showing how to create income from your savings.

Whether you've saved a little or a lot, you need a plan to ensure you're making the most of your assets.

THE MARIACA BOTTOM LINE

There are thousands of ways to generate portfolio income and claim social security benefits, and many retirees make the mistake of a implementing a withdrawal strategy that ignores the implications of how drawing from different types of retirement accounts will affect taxes. But the difference between a good withdrawal strategy and claiming early, as most Americans do, can be tens, if not hundreds, of thousands of dollars and additional years of portfolio income.

Coordinating a smart withdrawal strategy with the timing of starting Social Security is arguably the most important financial decision of retirement, so it only makes sense that these decisions are incorporated in your overall strategy, however, most investors do not do this kind of planning because their advisor . . . or because they do not even know it exists/it is important.

Our retirement income planning analysis provides a comprehensive, personalized report that includes an optimal withdrawal strategy that will result in the most cumulative retirement income possible, educational text to help you/consumers understand how these different withdrawal strategies may benefit them, and detailed instructions on how to implement the plan including when to make Roth conversions and smart withdraws. Furthermore, the report will illustrate side-by-side how various strategies compare in long-term tax implications, total value benefits, lower RMDs, and managing Medicare premiums.

Frequently Asked Questions

Your Medicare premiums are based on your modified adjusted gross income. A smart retirement income strategy will guide you towards withdrawal strategies that do not change your income above a threshold that will increase your premiums.

- Build and update a financial plan based on your specific situation

- Properly allocate your portfolio based on your tolerance for risk

- Rebalance your portfolio each year to keep it aligned with your overall plan.

- Offer insight and coaching to prevent you from an over-reaction to the market or world events

- Alert you if you veer off course and provide clear actions to get back on track Recommend tax-savvy income creation strategies

- Enable you with tools that will monitor your progress

- Explain decumulation and tax-efficient income distribution strategies

- Coordinate your Social Security benefits planning with other income sources

- Provide quality referrals to specialists in taxes, estate planning, and long-term care when appropriate

*Case Study Assumptions

They maintain a 50% stocks-50% bonds after-tax asset allocation with stocks earning 9% per year including 2% dividend yield and bonds earning 3% interest per year. For the stocks, 20% of capital gains are realized each year with all gains being long term. The original cost basis of assets held in the taxable account is set at the market value. His Primary Insurance Amount for Social Security is $2,500 a month and hers is $1,500 a month. They both have Full Retirement Ages of 66, begin Social Security benefits at 66, and receive their Primary Insurance Amounts. We assume one partner dies in 16 years at age 78 and the survivor lives on 75%of the real amount they lived on when both were alive. Both Strategies locate stocks and bonds in the accounts (i.e., taxable account and 401(k)s) in a tax-efficient manner, while maintaining the 50% stocks-50% bonds after-tax asset allocation. We can help clients with this asset-location decision, which may further extend the portfolio's longevity. Based on today's Tax Code, they will usually be in the 25% tax bracket in retirement. They take the standard deduction each year. Inflation is 3% per year with all tax brackets, standard deduction, over 65 tax exemption, and personal exemption amount rising with inflation. This information is provided for general informational purposes. The securities and strategies referred to in the information may not be suitable for you; therefore, it is important that you consider the information in the context of your own investment needs and objectives, including risk tolerance, investment goals and time horizon. This information is not intended to be a substitute for specific individualized investment planning advice.

Important Disclosure: The above case study is hypothetical and does not involve an actual Mariaca Wealth client. The case study is for illustration purposes only and it is not intended to provide you with any customized investment advice. Nothing in this case should be considered as a recommendation or advice to buy, sell or continue to hold securities or other investments, or take any specific action regarding any tax matters. Accordingly, certain of the securities and strategies referred to may not be suitable for all clients. No portion of the content should be construed by a client or prospective client as a guarantee that he/she will experience the same or certain level of results or satisfaction if Mariaca Wealth is engaged to provide investment advisory services.