Services

Services

Investment Consulting

Our investment approach

We help you preserve, protect and grow your wealth through a disciplined, non-reactive, and evidence-based approach to investing. As CEFEX-certified advisors we are committed to fiduciary wealth management and adhere to the industry’s highest standards of practice for High Net Worth Wealth Management and Retirement Planning.

Your disciplined, diverse portfolio

We also take a diversified, disciplined approach to portfolio management. We'll design your investment portfolio to help optimize your returns while mitigating your risk. Since 2007, we've worked with Dimensional Fund Advisors (DFA), a leading global investment firm that has been translating academic research into practical investment solutions since 1981.

Our investment consulting

To help you align your investment portfolio with your personal values and retirement goals, we'll conduct an in-depth:

- Performance analysis

- Risk evaluation

- Asset allocation

- Tax ramifications

We'll also assess the costs of your current holdings,

help you uncover any hidden fees or commissions that

you may have been paying, and make recommendations for zero commission, low-fee alternatives.

Exclusive access to funds

As fee-based fiduciaries, we have exclusive access to low-cost mutual funds offered by DFA.

Sustainability investing

For socially and environmentally conscious investors, we offer sustainable investment strategies that place greater emphasis on companies considered to be acting in more socially and environmentally responsible ways within a highly diversified and efficient investment strategy.

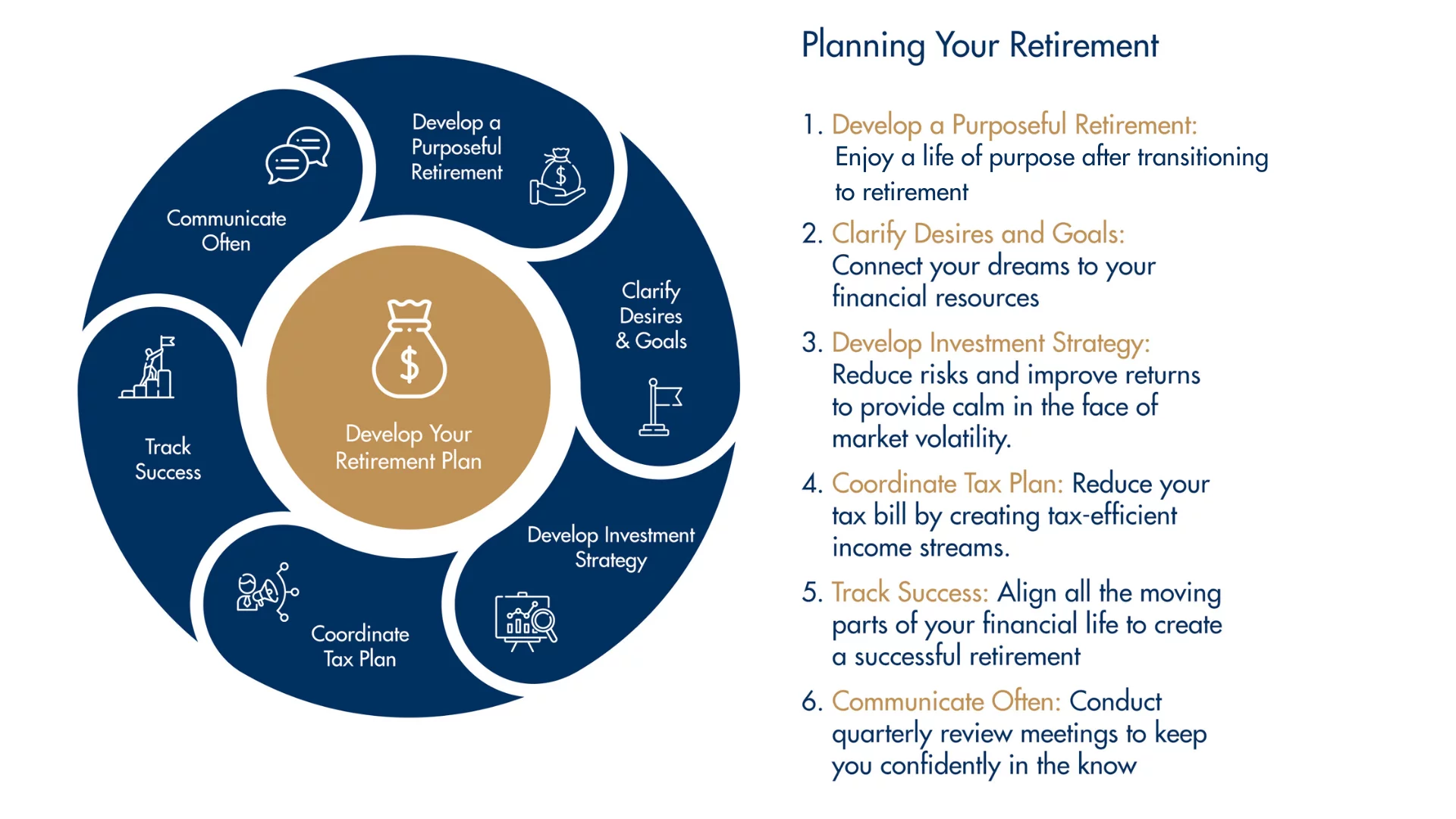

Retirement Planning

Plan to have enough

Ready to transition from a steady paycheck to retirement savings? We're here to help you do just that. Your financial life has a lot of moving parts and, when you make the transition from living off your paycheck to living off your savings, many of those parts change roles. We're here to help you align all the moving parts to create your definition of an ideal retirement.

Decide what you want to do and how you want to live, then plan for a retirement that supports that life

Your retirement plan is a living, breathing document. We use an advanced financial planning software to build your plan, track its success rate, and adjust for life's unknowns.

Coordinate tax-efficient income streams

Minimize how much of your hard-earned savings goes to taxes while setting up the most-tax efficient income stream strategy.

- Develop a Purposeful Retirement:

Enjoy a life of purpose after transitioning to retirement - Clarify Desires and Goals:

Connect your dreams to your financial resources - Develop Investment Strategy:

Reduce risks and potentially improve returns to provide calm in the face of market volatility - Coordinate Tax Plan:

Reduce your risk of tax bill by creating tax-efficient income streams - Track Success:

Align all the moving parts of your financial life to create a successful retirement - Communicate Often:

Conduct review meetings as needed to keep you confidently in the know

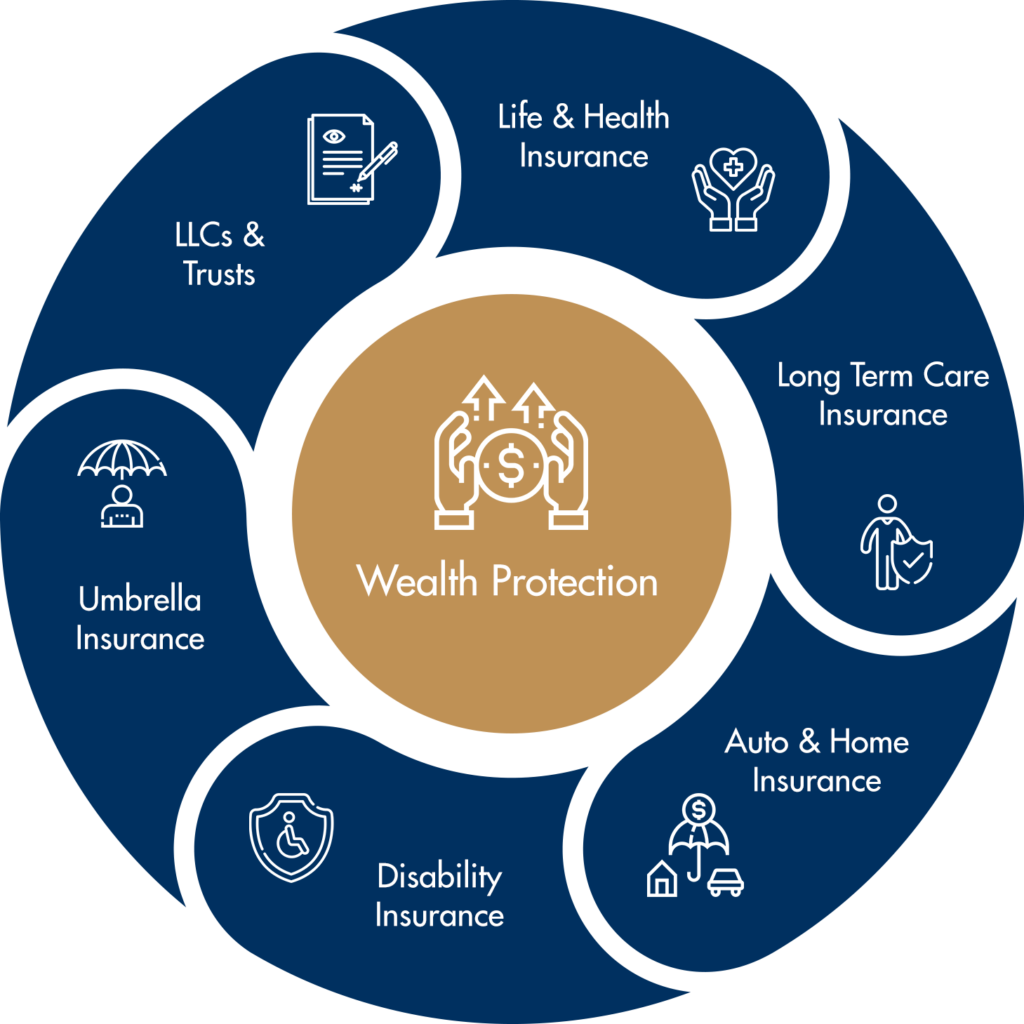

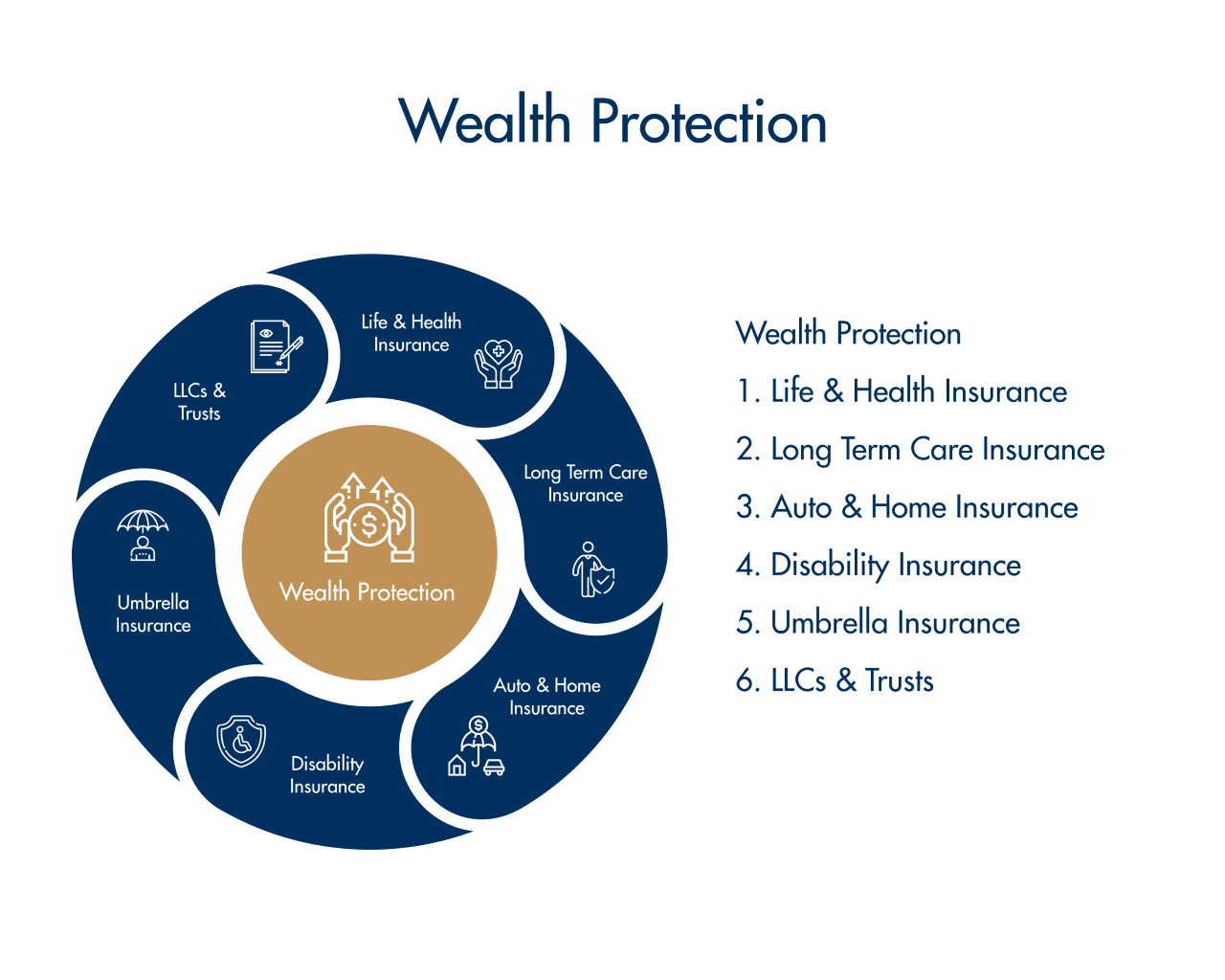

Wealth Protection

Maximize Protection; Lower Annual Costs

We have trusted professionals that will provide a neutral second opinion on how you're protecting your wealth.* We can conduct an analysis of existing coverage and identify any gaps you may have in the following areas:

- Life & Health Insurance

- Long Term Care Insurance

- Auto & Home Insurance

- Disability Insurance

- Umbrella Insurance

- LLCs & Trusts

Following the analysis, we'll refer you to qualified partners who can deliver the best policies at the best price.

Wealth Transfer

Skillful Wealth Transfer

Having a wealth transfer plan in place will support the people and causes most important to you. First, we'll work with you to clarify your values then develop wealth transfer strategies and plans that align with your values and priorities. We will work with you, your tax advisor and estate planning attorney, to create and implement a coordinated plan that intrigues your lifetime and legacy objectives.

- Aligning your plan with your values

- Finding ways to share your stories, as well as your wealth

- Passing along connections and impact

- Integrating Wealth Transfer Mechanisms

Enjoy the peace of mind that comes from knowing your hard work can have a lasting impact for years, possibly generations to come.

Non-Profit Planning

Retirement Plans & Financial Guidance for Non_Profits & Organizations

As fee-only fiduciaries and CEFEX-certified Investment Advisors for ERISA retirement plans, we help non-profits, government institutions and other corporate organizations develop highly successful retirement and financial investment plans.

As retirement plan fiduciaries, we also:

- Optimize your retirement plan's design so it supports your organization's goals and improves participants' "retirement readiness"

- Draft and maintain your plan's Investment Policy Statement (IPS)

- Recommend investment options and provide ongoing performance monitoring and benchmarking

- Recommend a qualified Default Investment Alternative (QDIA)

- Provide vendor valuations and recommendations

- Form and support your Retirement Plan Committee

- Provide fee benchmarking so you can conduct an apples-to-apples comparison and maximize your plan's negotiating leverage

- Customize content for your plans participants in order to get them invested in their own financial wellness

- Provide quarterly performance reviews and analyze investment performance

Investment Consulting

Our investment approach

We help you preserve, protect and grow your wealth through a disciplined, non-reactive, and evidence-based approach to investing. As CEFEX-certified advisors we are committed to fiduciary wealth management and adhere to the industry’s highest standards of practice for High Net Worth Wealth Management and Retirement Planning.

Your disciplined, diverse portfolio

We also take a diversified, disciplined approach to portfolio management. We'll design your investment portfolio to help optimize your returns while mitigating your risk. Since 2007, we've worked with Dimensional Fund Advisors (DFA), a leading global investment firm that has been translating academic research into practical investment solutions since 1981.

Our investment consulting

To help you align your investment portfolio with your personal values and retirement goals, we'll conduct an in-depth:

- Performance analysis

- Risk evaluation

- Asset allocation

- Tax ramifications

We'll also assess the costs of your current holdings,

help you uncover any hidden fees or commissions that

you may have been paying, and make recommendations for zero commission, low-fee alternatives.

Exclusive access to funds

As fee-based fiduciaries, we have exclusive access to low-cost mutual funds offered by DFA.

Sustainability investing

For socially and environmentally conscious investors, we offer sustainable investment strategies that place greater emphasis on companies considered to be acting in more socially and environmentally responsible ways within a highly diversified and efficient investment strategy.

Retirement Planning

Decide what you want to do and how you want to live, then plan for a retirement that supports tat life

Your retirement plan is a living, breathing document. We use an advanced financial planning software to build your plan, track its success rate, and adjust for life's unknowns.

Coordinate tax-efficient income streams

Minimize how much of your hard-earned savings goes to taxes while planning while setting up the most-tax efficient income stream strategy.*

Maximize Protection; Lower Annual Costs

We have trusted professionals that will provide a neutral second opinion on how you're protecting your wealth.* We can conduct an analysis of existing coverage and identify any gaps you may have in the following areas:

Following the analysis, we'll refer you to qualified partners who can deliver the best policies at the best price.

Skillful Wealth Transfer

Having a wealth transfer plan in place will support the people and causes most important to you. First, we'll work with you to clarify your values then develop wealth transfer strategies and plans that align with your values and priorities. We will work with you, your tax advisor and estate planning attorney, to create and implement a coordinated plan that intrigues your lifetime and legacy objectives.

We'll help you consider strategies for:

Enjoy the peace of mind that comes from knowing your hard work can have a lasting impact for years, possibly generations to come.

Retirement Plans & Financial Guidance for Non_Profits & Organizations

As fee-only fiduciaries and CEFEX-certified Investment Advisors for ERISA retirement plans, we help non-profits, government institutions and other corporate organizations develop highly successful retirement and financial investment plans.

As retirement plan fiduciaries, we also:

- Optimize your retirement plan's design so it supports your organization's goals and improves participants' "retirement readiness"

- Draft and maintain your plan's Investment Policy Statement (IPS)

- Recommend investment options and provide ongoing performance monitoring and benchmarking

- Recommend a qualified Default Investment Alternative (QDIA)

- Provide vendor valuations and recommendations

- Form and support your Retirement Plan Committee

- Provide fee benchmarking so you can conduct an apples-to-apples comparison and maximize your plan's negotiating leverage

- Customize content for your plans participants in order to get them invested in their own financial wellness

- Provide quarterly performance reviews and analyze investment performance

*Mariaca Wealth Management, LLC does not provide tax or legal advice. Please consult a qualified professional for assistance with any tax or legal issues, such as wills and trusts.